In the intricate web of global finance, IBAN and BIC/SWIFT codes stand as the linchpins of international transactions. These alphanumeric strings may seem cryptic at first glance, but they are essential for ensuring that funds navigate the complex network of banks across borders accurately and swiftly.

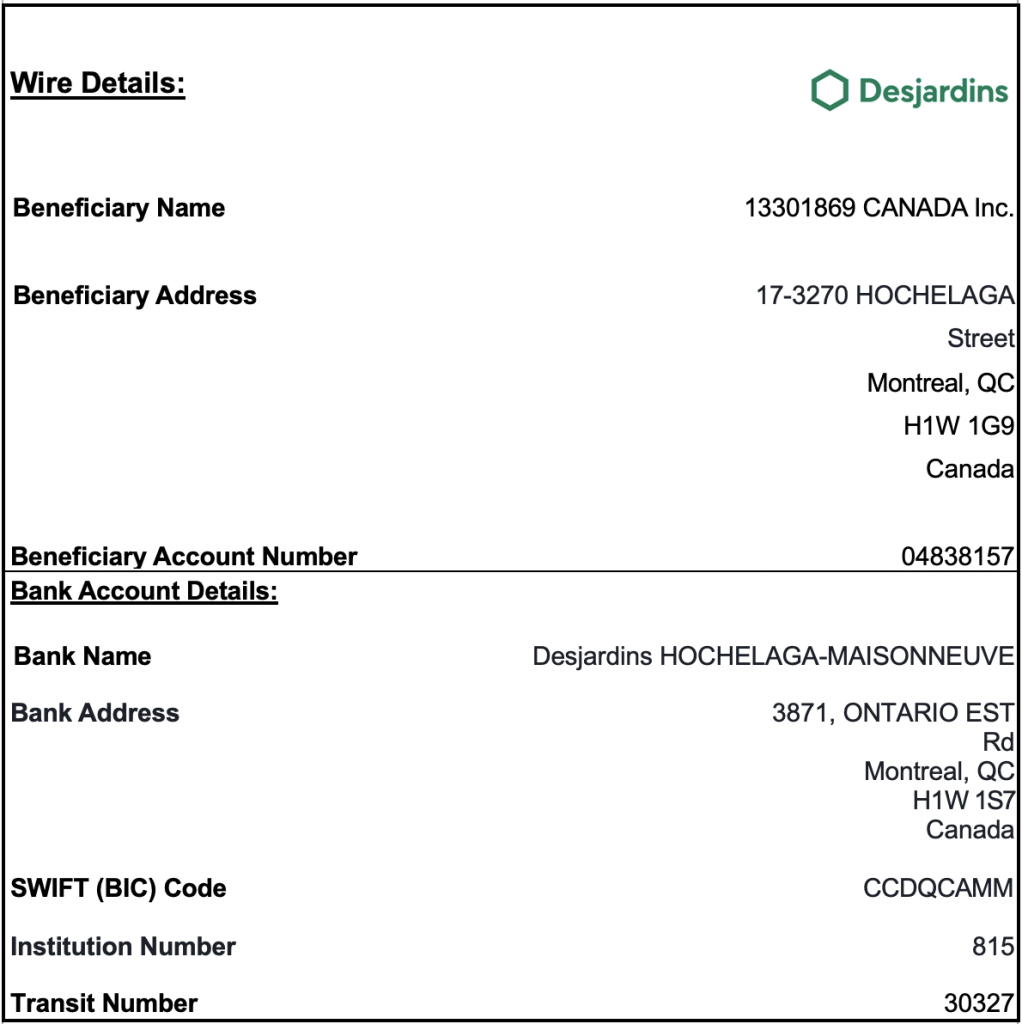

IBAN, or International Bank Account Number, is a unique identifier that helps in pinpointing an individual account involved in international transactions. It’s a standardized way of representing a bank account number across different countries, thus facilitating error-free cross-border payments. An IBAN can contain up to 34 characters, starting with a country code, followed by two check digits, and a long and detailed bank account number.

On the other hand, BIC, or Bank Identifier Code, commonly referred to as SWIFT code, is used to identify a specific bank during an international transaction. It’s an 8-11 character code that includes a bank code, country code, location code, and, optionally, a branch code. While IBAN provides the account-specific details, the BIC/SWIFT code identifies the bank’s address in the financial network.

Together, these codes form the backbone of international wire transfers and SEPA payments. They ensure that the money reaches the correct bank and account without unnecessary delays or errors. For anyone making or receiving international payments, understanding and using these codes correctly is not just beneficial; it’s imperative.

As globalization knits the world’s economies ever closer together, the role of IBAN and BIC/SWIFT codes becomes increasingly vital. They are not just random sequences of letters and numbers but the keys to unlocking seamless global transactions. By decoding these codes, we ensure the lifeblood of international commerce flows unimpeded, connecting businesses, families, and individuals across the globe.